What You Need to Know about Labour’s Proposed VAT on Private School Fees

Introduction

What is Labour’s policy on placing VAT on private school fees? This question has been the subject of much speculation, with over three million search results on the internet for the phrase “Labour Party VAT school fees.” This article aims to provide clarity on the potential change in the VAT liability of school fees under a Labour administration, avoiding unnecessary speculation.

Existing VAT Exemption for Private Education

A Long-standing Exemption

Exemption from VAT for primary and secondary education was introduced in the Finance Act 1972, when VAT relief was first granted for education “provided by a school,” together with “any goods or services incidental to the provision of education,” and the “provision of any instruction supplemental to the provision of any education.” These core concepts have survived successive Finance Acts and court decisions and are now enshrined in the VAT Act 1994. Although the wording may have changed over time, the VAT exemption for private education has remained remarkably consistent in its application for over 50 years since the inception of VAT on 1 April 1973.

Labour’s Proposed Changes

The £1.6bn Target

The Labour Party has announced its intention to introduce VAT on private school fees, with a figure of £1.6bn per year routinely cited by both the Labour Party and most media reporting. This figure is supported by a report published by the Institute of Fiscal Studies (“IFS”) in July 2023, entitled “Tax, private school fees and state school spending.” The IFS made several assumptions in support of its calculations, including:

– VAT will be imposed on both day fees and boarding fees.

– Nursery fees are excluded, assuming they are covered by the free entitlement to early education and childcare.

– Fees paid by foreign pupils should be included, as the service is consumed within the UK.

– 20% of private school costs are subject to VAT at 20%, with about £340 million deducted for VAT paid across the sector, as the sector would be entitled to fully offset VAT on its costs against the VAT paid to HMRC.

– Specialist provision would remain exempt from VAT, particularly fees for pupils with education, health, and care plans.

Unpicking the Current VAT Exemption

Any changes must unpick the current VAT exemption. Private schools secure exemption for education and the provision of related goods and services because they are “eligible bodies,” as defined by the VAT Act. A private school may be an eligible body for either or both of the following reasons:

1. It is a school, as defined by various Education Acts.

2. Its constitution prevents the distribution of any profits on its educational activities, which is most likely the case if it is a charity.

To achieve the £1.6bn target, VAT law will need to:

– Remove independent schools from the list of eligible bodies without also removing specialist providers of education, such as for pupils with education, health, and care plans.

– Remove the VAT exemption from a defined cohort of independent schools restricted from distributing their profits, without the unintended consequence of the loss of VAT exemption for other charitable and third sector organisations.

Once these changes are made, private schools can no longer rely on the VAT exemption for the fees charged for the provision of education.

Closely Related Goods and Services

The VAT exemption additionally provides relief from VAT for “closely related” goods and services provided by eligible bodies. HMRC accepts that the following qualify as closely related:

– Accommodation

– Catering

– Transport

– School trips

– Field trips

To achieve the intended £1.6bn outcome, and remembering that the IFS included boarding fees in its calculations, HM Treasury solicitors should specify that closely related goods and services are included in any legislation as specifically liable to 20% VAT.

There is precedent for including supplies within the VAT net that may otherwise be zero-rated or exempt from VAT, such as publications provided as a linked supply with the provision of education.

Anti-forestalling Provisions

The Labour Party has stated it will backdate the introduction of these measures to frustrate prepayment of school fees for future years and ensure it meets its targets for additional VAT receipts. It cites steps taken in 2011 by the coalition government when the rate of VAT increased to 20%. These are known as “anti-forestalling” provisions.

While there is precedent for the introduction of anti-forestalling measures, it is typically not backdated earlier than an announcement in a Budget introducing the change.

Planning for the Future

Søren Kierkegaard’s Wisdom

“Life can only be understood backwards; but it must be lived forwards.” This quote from Søren Kierkegaard is a good starting point for planning for the potential changes in VAT liability for private school fees.

Immediate Actions

In terms of planning, you can take the following immediate actions:

– Change your accounting software to separately record VAT on your costs. This will make it easier to secure full VAT recovery in the future.

– Record all building and renovation work in the last ten years with total spend above £250,000. You can secure partial recovery of VAT on these costs following the imposition of VAT.

– Assess whether 20% of your school’s costs are liable to VAT at 20%. Any recovery of VAT mitigates the impact of VAT payable on school fees.

Additional Considerations

– Offering parents the opportunity to prepay fees now for the next academic year. It is hard to see any legislation being backdated beyond the general election, but not impossible to see legislation barring prepayment further than the academic year in which it is introduced.

– Do not make changes that are not cost-free, such as the establishment of separate trading entities. Until we know the form of any changes to VAT law, any changes that seek to ringfence certain business income are inherently risky.

– Avoid using ideas without a thorough understanding of the basis in VAT law, and the potential downside risks to the school in terms of penalties and interest if the idea does not withstand challenge from HMRC.

How much will this cost parents?

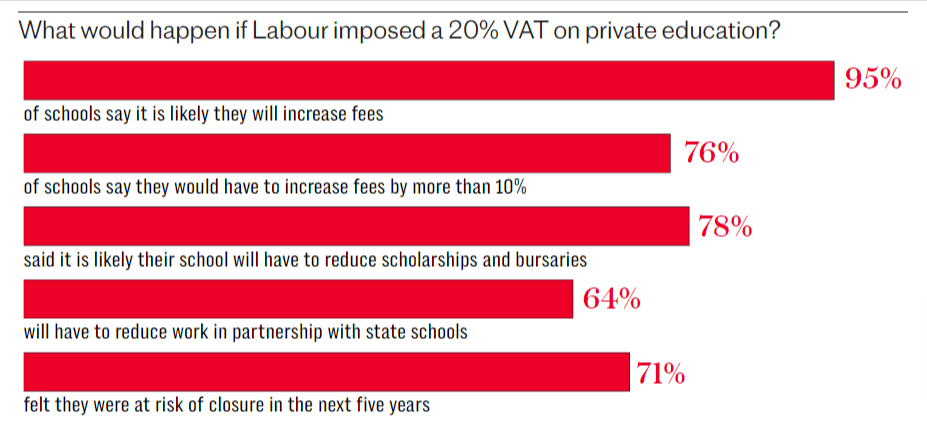

The average school fees in the UK are believed to be approximately £16,500 per year, therefore adding VAT on top will take the total payable to around £20,000, per child, per year!

Despite the narrative, the vast majority of children in Independent schools are not from wealthy families, that is actually a small percentage, the vast majority are from hard working families who make sacrifices in order to be able to pay the fees, to give their children a better start in life. These are the very people who Labour are intending to target. It would be wrong to even refer to many of these people as ‘middle class’ as many are people who work everyday jobs, pay mortgages or even rent and all they want is a better future for their children and Keir Starmer has no problem punishing them.

What do Reform UK offer as an alternative?

Reform UK are not only pledging to never add VAT to school fees, but in addition to this, we are also proposing that parents who make the sacrifice to pay school fees, to send their children to independent schools should be supported, because every child that is educated independently, results in one less child being educated by the state.

Therefore, we will offer parents 20% tax relief on school fees, which when compared to Labour’s education tax grab, results in a huge saving for parents.

In fact, when taking the average school fees of £16,500 per year, the saving for parents with Reform UK is around £6,000 per year, when compared to the cost under Labour!

Conclusion

– Labour has announced plans to introduce VAT on private school fees, targeting £1.6 billion in additional revenue per year based on estimates from the Institute for Fiscal Studies.

– To achieve this, VAT law would need to be changed to:

– Remove independent schools from the list of VAT exempt “eligible bodies”

– Remove the VAT exemption specifically for private schools restricted from distributing profits

– Specify that closely related goods/services like accommodation and school trips are subject to 20% VAT

– Labour intends to use “anti-forestalling” provisions to backdate the changes and prevent prepayment of fees before implementation.

– Private schools should take steps now to prepare, including:

– Updating accounting to separately track VATed costs

– Documenting recent construction projects over £250,000 for partial VAT recovery

– Considering timing of prepaid fees and capital projects around the changes

– Caution is advised against major restructuring or using untested VAT planning ideas that could face HMRC challenges.

– Professional guidance is recommended to understand the full impact and properly plan for maintaining profitability under Labour’s proposed VAT policies.

There is an inherently uncertain future regarding Labour’s proposed VAT on private school fees. As always, professional guidance is available to help you understand the tax effect on your organisation and preserve its future profitability and viability.

Ultimately, this is clear evidence that the Labour party is not a party that wishes to encourage success amongst everyday people unless it is those who are within the ‘Labour Party Fold’ and just the mere assumption that they will be in power soon, has seen them rubbing their hands together as they plot to rob Peter to pay Paul, then they will subsequently rob Paul to pay their friends.

There is no doubt that a Labour administration will be truly catastrophic for the UK.